1031 Exchange Rules and Regulations: An Investor’s Guide

Benjamin Franklin wrote “… in this world nothing can be said to be certain, except death and taxes.” For investors this statement is only partially true so long as Section 1031 of the United States Internal Revenue Code (26 U.S.C. § 1031) remains in effect. But without a thorough understanding of the rules that govern a 1031 exchange, even the most savvy investor may fall short of the requirements to defer taxes and build wealth.

If properly structured, a 1031 exchange provides investors a multitude of benefits including:

- Deferral of tax for Federal capital gains, state ordinary income, net investment income, and depreciation recapture.

- Build and preserve wealth.

- Diversify into new asset classes and markets.

- Consolidate or diversify real estate portfolios.

- Leverage purchasing power.

- Increase cash flow and returns.

- Estate planning for future generations.

IRC Section 1031 (a)(1) states:

“No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of like kind which is to be held either for productive use in a trade or business or for investment.”

Types of property excluded from a 1031 exchange:

- Inventory or stock in trade

- Stocks, bonds, or notes

- Other securities or debt

- Partnership interests

- Certificates of trust

The 2018 Tax Cuts and Job Act made the 1031 exchange exclusive to real property, excluding your personal residence, vacation homes, and property held primarily for resale (i.e. flips are excluded as they are viewed as inventory held for sale).

More than one path to an exchange

Simultaneous Swap: The simplest form of exchange, but can be difficult to execute as an investor must transact simultaneously (same day) on both their relinquished and replacement property. Timing can be complicated by third party buyers and sellers who are operating with their own set of objectives. If executed can be the most lucrative for all parties, reducing downtime and loss of income.

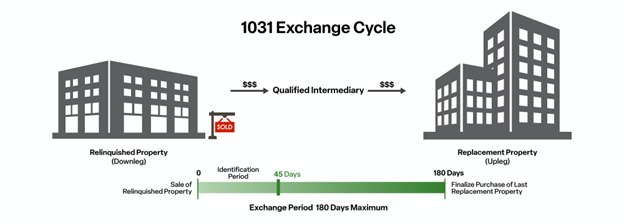

Deferred Exchange: The most common form of exchange due to its flexibility, allows an investor to relinquish property and subsequently purchase a replacement property within 180 days. Additional complexities with this type of exchange make it increasingly important to engage qualified professionals early to ensure no missteps are taken that would disqualify the exchange.

Reverse Exchange: Notably more complex than a deferred exchange, a reverse exchange occurs when an investor acquires their replacement property first through an exchange accommodation titleholder. Within 180 days of the acquisition the investor must sell their relinquished property to complete the exchange.

Rules and regulations for a successful 1031 exchange

- Engage a qualified intermediary: an investor must not take constructive receipt of cash or other proceeds from the sale of the relinquished property. All cash or other proceeds from the sale must be handled by a qualified intermediary.

- Equal or greater value: To fully defer capital gain taxes upon sale, the investor must (1) invest all proceeds from the sale into the replacement property, and (2) replace debt on the relinquished property with debt or outside cash on the replacement property. An easy way to accomplish this is to acquire replacement property that is of equal or greater value than the relinquished property.In a difficult lending market it is important to recognize that an investor may inject additional cash into a deal vs. taking out a loan. In many instances today, the cash on cash return is greater than the leveraged return due to elevated interest rates. As debt markets settle an investor has the ability to refinance the property and pull out equity.

- Use Requirement: The investor must intend to use the replacement property for investment or business purposes. Property purchased for personal use (i.e. a second home or vacation property) could disqualify the exchange.A business owner may exchange real property held in their business for real property held for investment, and vice versa, an investor may exchange real property held for investment for real property to be used in their trade or business.

- 45-day identification period: investors have 45-days to identify replacement property from close of the relinquished property.

- 180-day rule: investors must close on one or more replacement property within 180-days from close of the relinquished property.

- Like-kind property: The relinquished property and replacement property must be like-kind. The properties must be of the same nature or character, but do not need to be identical. For example, land can be exchanged for an apartment building or other commercial property.

- Property Identification: An investor may dispose of one property and acquire multiple properties subject to the following identification rules.

- Three-Property Rule: Identify up to three replacement properties, regardless of their fair market value. At least one property must be acquired.

- 200% Rule: Identify any number of replacement properties as long as their aggregate fair market value doesn’t exceed 200% of the relinquished property’s value. Only one property must be acquired.

- 95% Rule: If the aggregate value exceeds 200% of the relinquished property and more than three replacement properties are identified, the investor must acquire 95% of the fair market value of all identified properties.

- Identification Standards: The IRS requires a clear and unambiguous description of the replacement property. This is generally accomplished through providing the legal description, or property address and tax ID to your qualified intermediary.

- Location Restrictions: An investor who sells a property in California may exchange for a property in Florida or any another state within the United States. However, an investor cannot exchange from a property sold in the United States into a property in another country. The reverse is also true, an investor cannot exchange from a property sold in another country into a property in the United States. An investor may exchange between two properties held abroad.

- Title Requirement: The taxpayer that owns the relinquished property must be the same taxpayer that acquires the replacement property in the exchange.

Take note: The IRS outlines the following restrictions that may disqualify all or part of your exchange:

- Taking control of cash or other proceeds before the exchange is complete may disqualify the entire transaction from like-kind exchange treatment and make ALL gain immediately taxable.

- To avoid premature receipt of cash or other proceeds use a qualified intermediary or other exchange facilitator to hold those proceeds until the exchange is complete. You can not act as your own facilitator. In addition, your agent (including your real estate agent or broker, investment banker or broker, accountant, attorney, employee or anyone who has worked for you in those capacities within the previous two years) can not act as your facilitator.

- Failure to meet the 45-day identification deadline will result in disqualification of the exchange. You may change your identification list up through the 45th day by formally revoking your prior identified properties and identifying new properties according to the identification standards.

- To fully defer taxes be wary of “boot” (value received in an exchange outside of like-kind property). If cash, relief of debt, property, or other proceeds that are not like-kind property are received at the conclusion of the exchange, the transaction will still qualify as a like-kind exchange, but only partial. Gain may be taxable, but only to the extent of the proceeds that are not like-kind property.

- Since 1921, the 1031 exchange has been an important tool for real estate investors. Despite its longevity, IRC Section 1031 will occasionally come under scrutiny, be amended, or receive temporary relief (i.e. most recently, due to natural disasters key dates have been extended to allow investors additional time to complete their exchange). To receive up to date notices on news impacting this key piece of the tax code, please subscribe to the CapWise Commercial Advisors, Inc. (“CapWise”) mailing list.

Tips for a successful 1031 Exchange

- Take the time to understand the rules.

- Establish your purchase criteria early. Too often buyers wait to establish their purchase criteria and find themselves up against the 45-day identification deadline. Don’t wait to think about what you want to buy until after you sell. This can leave you with a less desirable property or paying the tax.

- Engage your network of professionals early. Make sure your real estate broker, attorney, tax professional, and qualified intermediary are clear on your objectives. This will help streamline the exchange process which moves quickly and can feel stressful.

- Talk with your lender or mortgage broker before you enter into a contract to ensure the property type and location is something they can finance.

- Engage a team of consultants (i.e. property condition, phase I, surveyors, zoning, property management, etc.) to help evaluate your replacement property. Don’t buy blindly, even if you are purchasing a newly constructed NNN asset with a credit tenant.

- Keep open lines of communication with your team and third party buyers and sellers. Keeping people informed will often smooth over any bumps in the road and help all parties achieve their respective goals.

In summary, a 1031 exchange is a powerful tool to defer taxes and build wealth, but there are a multitude of rules and regulations that can derail a successful exchange. It is imperative that investors work with a team of qualified professionals to meet these standards.

CapWise is here to help you navigate the complexities of your 1031 exchange. From selling your property, to helping you identify your replacement and securing new commercial real estate financing, CapWise works tirelessly to help you achieve your investment goals. CapWise maintains national relationships with real estate brokers and lenders to ensure that our clients have access to the entire market. We leverage these relationships to your benefit.

Please reach out to learn more about our services and how we can help.

This material is for general information and educational purposes only. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

CapWise Commercial Advisors, Inc. does not provide tax or legal advice. This material is not a substitute for seeking the advice of a qualified professional for your individual situation.

About The Author

Ben Faubion is a licensed commercial real estate broker in the State of California. He is a former CPA (inactive) and has worked as an advisor at both national and regional real estate consulting firms. Ben leverages his diversified background to assist clients in creating value in their commercial real estate holdings, including investment, debt financing, and leasing.